The SBA 504 Loan Program

When it comes to purchasing your own building the SBA504 is considered one of the most desirable ways to achieve your goal of obtaining the combination of maximum leverage with incredibly competitive rates.

SBA 504 loans are designed to help small businesses owners purchase, construct or improve an existing commercial building as well as buy and install heavy machinery and equipment.

Advantages of a SBA 504 Loan:

- Long term fixed rate product. SBA504 loans provide Borrowers with a below market 20yr fixed rate second mortgage. BREAKING NEWS: Effective May-June 2018 the SBA504 fixed rate will increase to 25 years!!!

- A low down payment allows the business to retain more capital in the business.

Typical conventional bank loans require at least a 20% down payment. The SBA 504 loan program has a down payment minimum of 10% thus allowing your business to retain the additional 10% for future working capital. (Please note for special-use properties that a down payment is 15% to 20% may be required). - No balloon payments

- The SBA 504 portion of your loan is government guaranteed. Therefore, unlike other loan programs, no additional collateral is required.

- Closing costs such as appraisal fee, environmental fees, contingency fees can be included in the financing

- Projected income consideration – The SBA can consider projected income of a business in addition to historical cash flows. This is particularly advantageous for growing businesses.

Structuring of a SBA504 Loan:

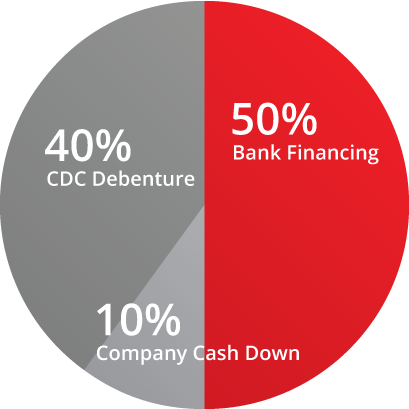

A SBA 504 loan has three participants (see chart below):

- A 1st Mortgage Lender who provides a first trust deed loan for at least 50% of the total project cost. Arrow Mortgage, LLC offers one the widest variety of SBA 504 first mortgage programs in the industry. We offer a 90 day ARM, 1yr ARM, 3yr ARM, 5yr ARM, a 7yr or a 10yr Fixed Rate that converts to a 5yr ARM and an extremely competitive 25 YEAR FIXED RATE!

- A 2nd Mortgage Certified Development Company (or “CDC”) who provides the SBA guaranteed portion of the SBA 504 loan for up to 40% of the total project cost, or a maximum of $ 5,000,000 (The maximum SBA 504 second mortgage can be raised up to $ 5,500,000 for manufacturing businesses and eligible “green” buildings).

- A Small Business Owner who contributes a down payment of at least 10%of the total project cost. (Please note that this amount could be raised up to 15%-20% for start-up businesses, change of business ownership and/or in combination with single purpose properties)

To Meet The Minimum Qualifications For A SBA 504 Loan The Business Must:

- Be organized as a for-profit business. Unfortunately, the SBA 504 program is not designed for non-profit businesses

- Be organized as a sole proprietorship, corporation, partnership or limited-liability corporation (LLC)

Other Eligibility Requirements:

- The business must occupy at least 51% of the existing building. For new construction to permanent loans the business must occupy at least 60% of the property.

- Equipment that is financed into the project must have a minimum 10-year remaining economic life

Interested in applying?

Please complete the enclosed form and a Representative from Arrow Mortgage, LLC will promptly contact you.

Free Initial Assessment

Contact us today to obtain a free initial assessment of your current financial situation

Email: info@commercialfunds.com

Phone: (321) 400-9060

Interested in applying?

Please complete the enclosed form and a Representative from Arrow Mortgage, LLC will promptly contact you.

Arrow Mortgage, LLC may be able to provide you with conventional real estate secured financing for your next project up to $8,000,000

If you are an established business owner and you are looking to purchase a property with a minimum down payment Arrow Mortgage, LLC may be able to provide you with up to 90% LTV with SBA 504 financing for your next project up to $ 13,000,000.

If you are a business owner and you are looking to refinance debt or purchase a property with a minimum equity injection Arrow Mortgage, LLC may be able to provide you with up to 90% LTV with SBA7(a) financing for your next project up to $ 5,000,000.

Arrow Mortgage, LLC may be able to provide you with real estate secured financing for your next project up to $50,000,000